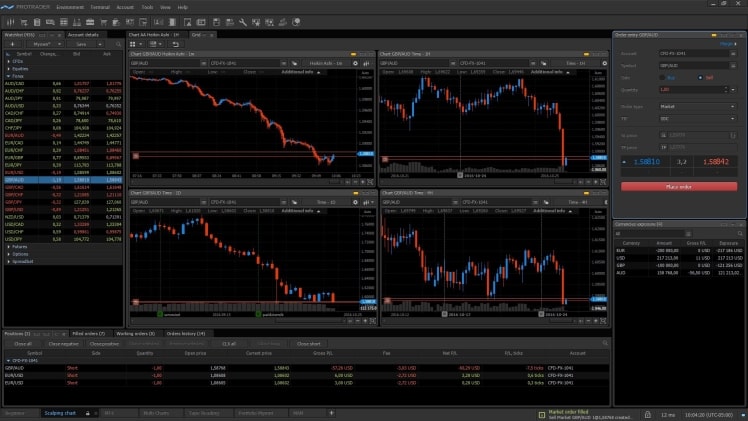

There are several award-winning trading platforms to start a trading career. Because of its simplicity, feature-rich environment, and automated trading capabilities, the MT4 platform is undoubtedly the biggest and most popular trading market for forex traders.

It has evolved from a trading system to a worldwide community where technology vendors’ ideas meet the needs of traders. The most well-known marketing account also is available on other prestigious trading platforms. Most of these terminals require Windows 7 or above, and they can also be operated on Mac OSX.

This essay will provide you with a comprehensive overview of the Meta Trader4 platform. Continue reading to learn more:

What Makes the Meta trader 4 Platform Unique?

Connectivity in Raw Pricing

By offering customers the Raw Pricing Connectivity, most key markets can offer market pricing plus trading conditions via the MT4 platform.

Raw Pricing Connectivity enables users to trade on institutional-grade marketplaces with a high level of liquidity. Clients may trade without a dealing desk, price manipulation, or requotes using Executable Streaming Prices (ESP) delivered from numerous liquidity sources to our Raw Pricing environment. They are also the international brokers of choice for big volume traders, scalpers, and robots that want one of the narrowest spreads and finest execution due to their liquidity mix, which includes up to 25 distinct price sources at any given moment.

Order fulfilment promptly

Intercontinental NY4 cloud infrastructure in New York hosts the MetaTrader 4 server. Over 600 buy and sell-side enterprises, exchange, trading venues, market data, and service providers are housed at the NY4 data centre, considered a financial sector. To provide minimal latency and quick trade execution, MetaTrader 4 platform is a bridge to the client’s network.

The server will have a latency of fewer than 0.1 seconds to prominent VPS providers. It will be co-located inside the NY4 server farm or connected via dedicated lines to surrounding data centres. This low-latency setting is perfect for automatic and high-frequency trading, as well as scalping.

No trading restrictions.

There are some of the best trading circumstances in the world for cutting and high-frequency trading, with no minimum purchase length and a freeze level of 0, allowing traders to make orders between the spread. It means one may set orders near the market rate they like, including stop-loss orders. The FIFO rule does not apply to all trading systems, where traders can hedge their holdings. Traders gain from margin netting by avoiding paying the excess on hedged deals.

Spreads start at 0.0 pips.

The trading platforms have some of the narrowest spreads among all forex brokers globally. Just on MetaTrader 4 platform, the spread starts at 0.0 pips, with an average of 0.1 pips 24/5 on EURUSD. It is one of the world’s narrowest average EURUSD spreads right now. Thanks to the availability of trading platforms combined with up to 25 different price sources, the cash flow for clients is stabilised in online trading platforms.

Supported Account Currencies: All Main Account Currencies

With a 1 point spread, trade 64 currency pairings and 16 major equity indexes, such as the S&P/ASX 200 and Dow Jones Index, 24 hours a day. Accounts with a leverage of up to 1:500 are available, as are trading platforms such as MetaTrader 4 and 5. Traders might employ more leverage to fit their trading strategy and get the most from human and automated trading tactics. Some platforms even allow traders to establish accounts in ten supported base currencies.